Automated & Accurate Payroll Management

Build your payroll structure using various pay heads like basic salary, bonuses, overtime, and deductions.

How POS Payroll Processing Works?

Session Filters

Filter by user, outlet, date, or counter for granular views.

Sales Breakdown

View subtotal, tax, discount, and grand total per transaction.

Order History

Review past orders with linked sessions and counters.

Return Reporting

Includes return amounts tied to original orders.

Live Totals

The system auto-calculates grand totals for each page.

How Payroll Processing Works?

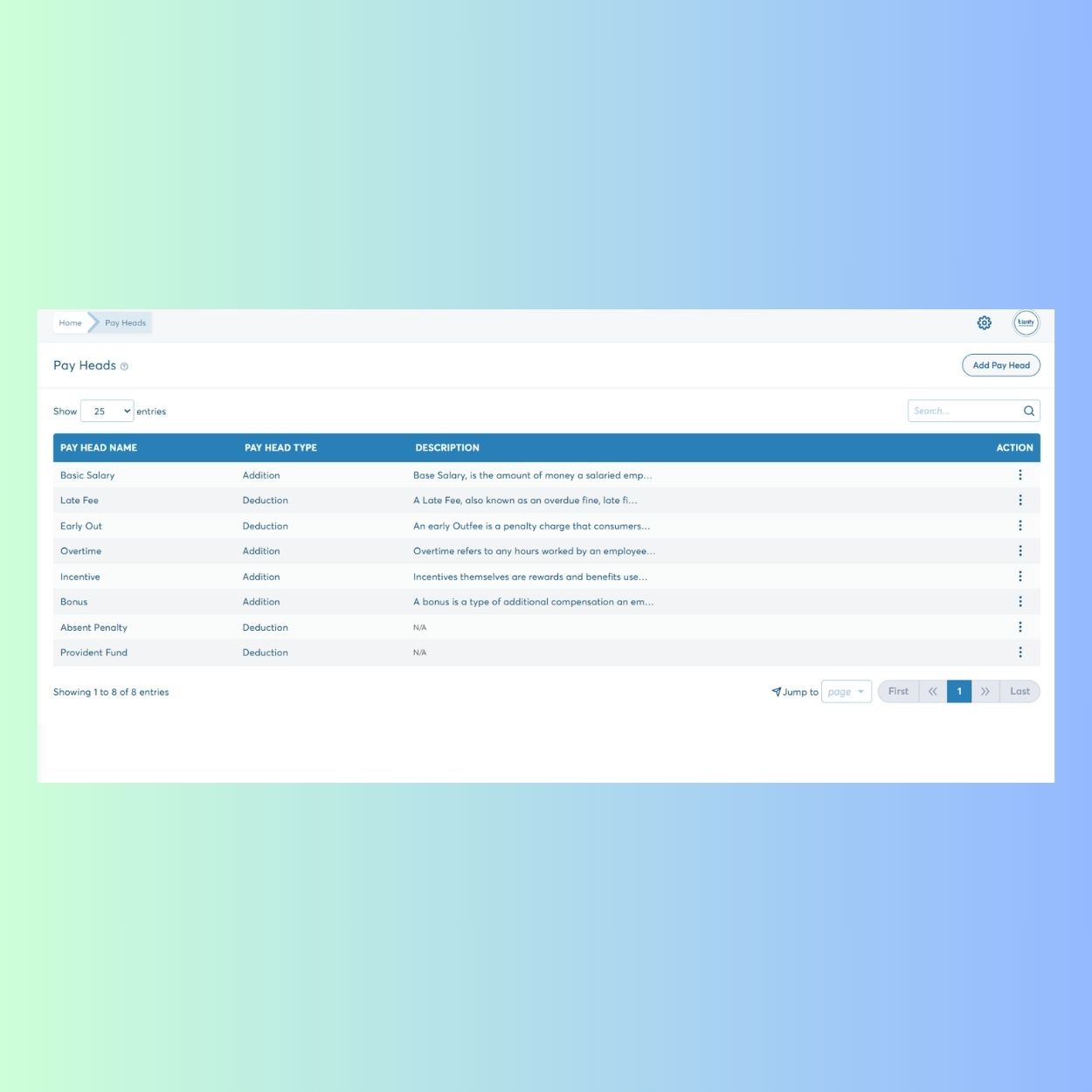

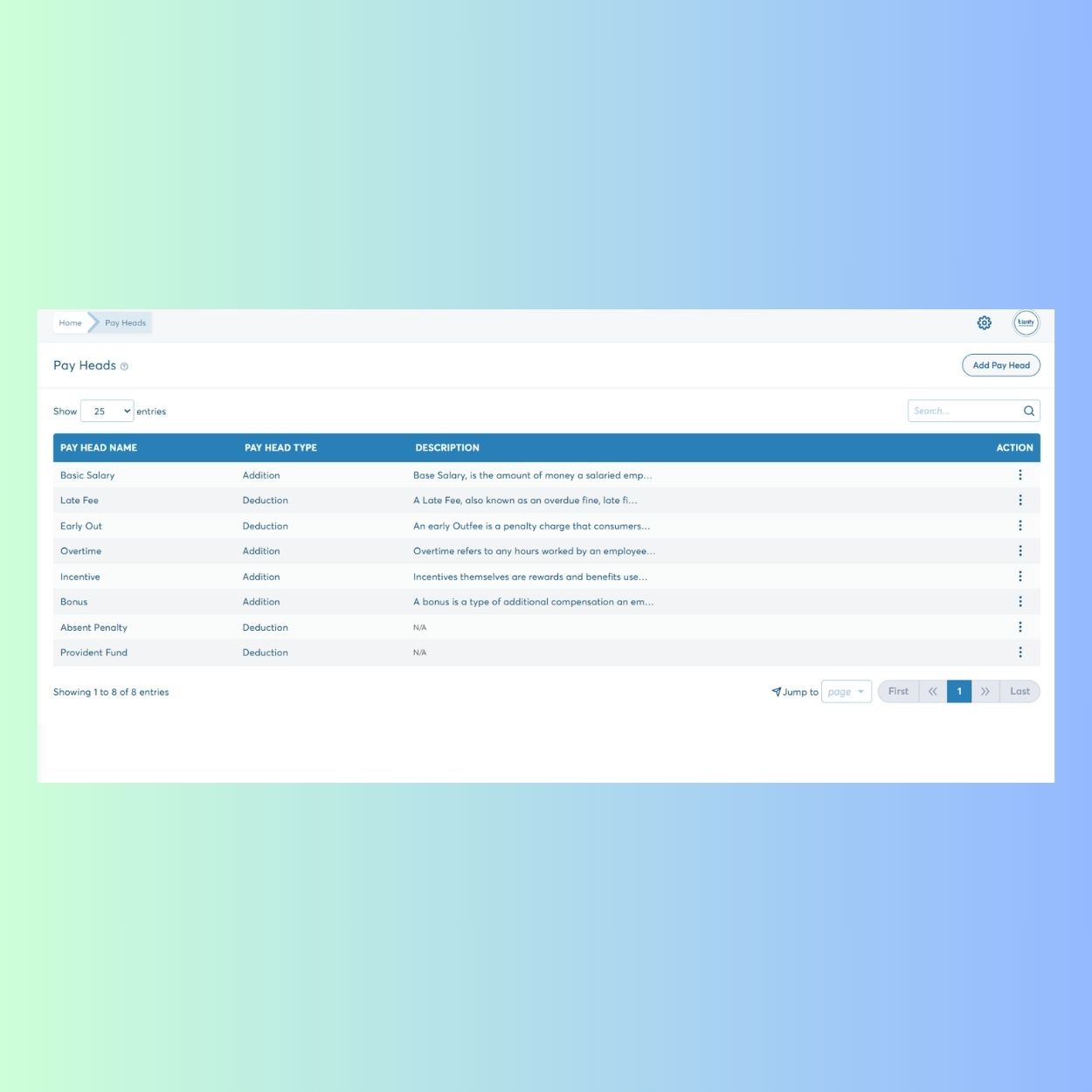

Pay Heads

Define income or deduction types like Bonus, Late Fee, and Incentive.

Description Tags

Explain each pay head with tooltips for HR reference.

Payroll Templates

Group payrolls by name and type (e.g., CEO, Billing).

Payment Types

Select how payroll is disbursed—Cash, Bank, or Other.

Integration Ready

Link pay heads to employee positions for automation.

Payroll Processing Faqs

Yes, both earnings and deductions are fully customizable.

Currently Cash; Bank integrations can be added.

No, they must be added manually unless tied to performance rules.

Yes, multiple payroll types are supported.

Connect With Our Experts

Get personalized solutions from our dedicated team of specialists available 24/7. Start your journey to success today.